This account is provided so that if anybody else has to appeal their charges to an insurance company, this might help them in some small way. Specifically, this account is of my appeal for coverage of my BAHA surgery, and my insurance company is Anthem Blue Cross, Blue Shield, but I’m pretty sure that many of the things covered here will be useful no matter what your particular procedure and insurance company.

This saga started when we attempted to get a pre-certification for the BAHA surgery. I was assured that this was a pretty routine procedure, and there was no doubt that it would be covered, so it was something of a surprise to be told that they had rejected the pre-certification. The first important note here is that it is the insurance company’s job to reject your claims. Do not be surprised when your first attempt is rejected, and, more importantly, don’t give up at this point. That’s what they’re hoping you will do. You must pursue it.

Fortunately, in my case, I had a number of people assuring me that the claim should have been approved. And I was directed to the Let Them Hear Foundation. I spoke with someone there, and she gave me the following tips. These tips are applicable to any insurance appeal.

Determine what your insurance company’s definition of “MEDICAL NECESSITY” is, and obtain a letter from your doctor stating that your surgery is motivated by medical necessity, using the phrasing that is used in your policy. Make sure that the letter covers as many of the points from your policy as possible.

Write a letter. It is important that there’s a letter from the doctor, but it’s more important that there’s a letter from you. You are the paying customer, but the company expects you to be ignorant and apathetic. If you get involved, it’s going to cost them more to say no than it would have to say yes. In your letter, be polite. If you are belligerent, they will ignore you. Be polite. Assure them that there’s been a misunderstanding, and you just want to make sure that they have all the facts. Be polite. Did I mention that you should be polite? Don’t threaten legal action, particularly in your first letter, or the next few. Don’t expect that one letter will be sufficient.

Be sure you understand why you’re getting the surgery. That is, in what specific ways will it enhance your life? Will it protect you from further sickness or injury? For example, I am deaf in my left ear. Thus, when I’m driving, I never hear vehicles pull up on my left side, which increases my chances of vehicular accident. Also, due to my loss of hearing, I find many work situations very frustrating. If I were a less stable individual, this might lead me to severe depression. Either of these things could cost the insurance company considerably more than just covering my surgery. Thus, I’m acting in the interests of the insurance company, and they should cover my surgery.

Find out what your policy says. Yes, this should be obvious. But if you take their word about what it says, and don’t check, chances are you’re not getting what you paid for.

In my case, my policy *seems* to contradict itself. In one place, it says that it does not cover services:

38. For hearing aids, or examination to prescribe/fit them, unless otherwise specified within this Benefit Booklet.

The operative phrase here appears to be the “unless otherwise specified”, because, as it happens, it IS otherwise specified.

Under “Covered Services”, it mentions

6. Cochlear Implant.

…

10. Hearing Aids – Any device or instrument that can be worn repeatedly. It is not designed to be disposable. It is designed to help or repair poor human hearing as best it can.

In this case, what I’m getting is not a cochlear implant, but it tends to get classified under the same set of surgery codes. But item 10 seems to pretty clearly contradict the statement in the “excluded services” section. So strange.

Find out what the law says in your state. Some states REQUIRE that hearing aids and hearing surgeries be covered. Laws differ from state to state and country to country. Do your research. If you can include a particular law name, number, paragraph, etc, in your letter, it will be taken more seriously.

If you send your letter via post, send it certified, or registered, with return receipt. That way you know when they got it, who signed for it, and they can’t pretend they didn’t get it. If you call, get a reference number for the call, and the name of the person you spoke with.

Find out how other insurance companies handle the same surgery. Tell them that they are being less competitive than the company that you’re considering switching to.

Find out the HCPCS code for the procedure in question. In the case of the BAHA, it is L8690. Interestingly, hearing aids are always in the V designation, while prosthetic devices are under L. Knowing how your procedure is classified can help you find the right way to talk about it so that it is covered. They play this same game to tell you it’s not covered, so don’t feel like you’re being dishonest.

In your letter, be sure to include the sections from your policy that you’re referring to, so that it’s not a question of interpretation. And be polite.

Right after Christmas, we received a letter from the insurance company, proving that even an insurance company can admit to making a mistake. They said that they had reevaluated their denial, and changed their decision, and the procedure is completely covered.

I’ll be having the surgery on January 6th.

I’ve included my appeal letter below. I was lucky. It only took one appeal letter. But I have the benefit of a British boarding school, where they taught us the right way to write letters. Maybe that had something to do with it.

December 16, 2008

Anthem Insurance

To whom it may concern,

I’m writing in regards to a recent pre-qualification, which was denied, for a procedure which, according to my insurance policy, should not have been a problem. I presume that there has simply been a misunderstanding regarding the procedure, and that, once this misunderstanding is corrected, we can proceed.

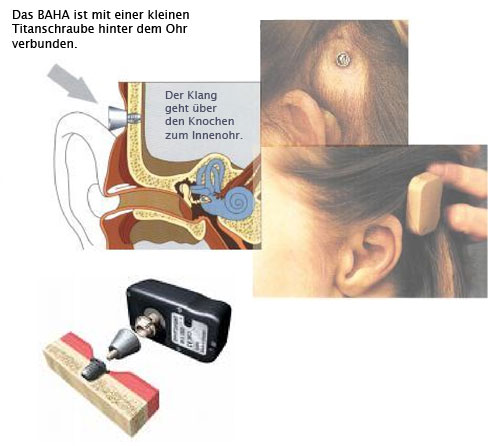

The procedure in question involves the BAHA Bone Anchored Hearing Appliance, which attaches to an implanted screw, to restore hearing to a damaged ear. This is not a traditional hearing aid, as was misunderstood by the individual who denied the pre-qualification. Several other insurance companies, including Aetna and Medicare, cover this procedure as a prosthetic device, since it restores functionality to a damaged or missing part of the body – in this case, the bones of the middle ear.

I also noted, on page M-27 of my benefits guide, given to me by my HR manager, that this kind of prosthetic surgery is explicitly covered: “10. Hearing Aids – Any device or instrument that can be worn repeatedly. It is not designed to be disposable. It is designed to help or replace poor human hearing as best it can.” On the other hand, in the section about exclusions, the phrasing is that hearing aids are not covered “unless otherwise specified within this Benefit Booklet.” And, since it is, indeed, specified elsewhere in the Benefit Booklet, this seems to be a pretty clear-cut case.

Thank you for your attention to this matter. As you can no doubt imagine, I greatly look forward to having my hearing restored. I anxiously await your response.

Sincerely yours,

Rich Bowen